Welcome to intercst's

"highly specialized",

impossibly sophisticated,

Early Retirement Planning Insights.

Welcome to intercst's "high-specialized", impossibly sophisticated, Early Retirement Planning Insights.

I have built this site as a location for cutting edge research related to retirement investment planning. Some people refuse to believe that the arithmetic behind retiring early is incredibly simple. All you have to do is live below your means (LYBM), save like crazy until you have a nest egg equal to 25 times your annual spending, then invest the money in a diversifed portfolio of equities and fixed income securities. Here's the concept in equation form.

N = 25 x E

where N = retirement nestegg balance,

and, E = annual living expenses.

Of course, that's too simple for a few people. They want to see a more complicated approach with more mathematical rigor and impressive, incomprehensible equations. To accomodate these disturbed individuals we can make a few arbitrary and random substitutions in the equation above.

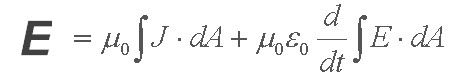

First we take E, the retiree's annual living expenses, and replace it with a random equation I copied from a college text on Multivariate Differential Equations.

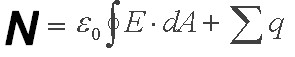

Next we take N, the required value of the retiree's nest egg, and replace it with this random equation from a College Physics text.

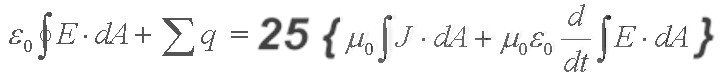

Adding the two equations above gives us this impressive looking string of indecipherable characters.

Obviously, these kinds of sophisticated insights should only be attempted by an experienced retirement prognosticator skilled in divining Hocus's Wave and comfortable in predicting the future. Mere mortals, should just use 4% or take their Hocomania to their graves as they attempt to amass a portfolio sufficient to support a 2% SWR.

Have fun.

intercst

|